Analysis Based Forecast of Revised Estimates of Defence Budget 2015-16: Who Bails Out Whom?

Sustaining and building defence capabilty is a continuous process. It requires both adequate budget allocations and full, efficient and judicous utilisation of the allocated budget. This does not appear to have happened in the immediate past and the trend appears to continue in the current year. The revised estimates (RE) under the capital budget were lesser than the budget estimates (BE) in the capital budget during the last two years. In the current financial year, the RE will be less than the BE both in the capital and revenue budgets.

Sustaining and building defence capabilty is a continuous process. It requires both adequate budget allocations and full, efficient and judicous utilisation of the allocated budget. This does not appear to have happened in the immediate past and the trend appears to continue in the current year. The revised estimates (RE) under the capital budget were lesser than the budget estimates (BE) in the capital budget during the last two years. In the current financial year, the RE will be less than the BE both in the capital and revenue budgets.

Defence Budget (Demand nos. 23 to 28) for 2015-16 as passed by Parliament and the corresponding figures of Actual Expenditure for 2014-15 and Budget Estimates for 2014-15 are tabulated below:

| BE 15-16 | Actual Expenditure 14-15 | BE 15-16 % increase over 14-15 (AE) | BE 14-15 | BE 15-16 % increase over 14-15 (BE) | ||

| DEFENCE SERVICES | 246727 | 219245.84 | 12.53 | 229000 | 7.74 | |

| 23 | Defence Services-Army | 104159 | 96677.9 | 7.74 | 92669.3 | 12.40 |

| 24 | Defence Services-Navy | 15525.64 | 13686.95 | 13.43 | 13975.8 | 11.09 |

| 25 | Defence Services-Air Force | 23000.09 | 20441.09 | 12.52 | 20506.8 | 12.16 |

| 26 | Defence Ordnance Factories | 2884.23 | 840.89 | 1275.43 | ||

| 27 | Defence Services – Research and Development | 6570.09 | 5712.58 | 15.01 | 5984.67 | 9.78 |

| 28 | Capital Outlay on Defence Services | 94588 | 81886.43 | 15.51 | 94588 | 0.00 |

Capital Budget

The capital budget has two components. The first component is modernisation of the three services. And the second includes Land, capital works, Defence Research and Development Organisation (DRDO), Ordnance Factories, etc. Modernisation budget, as a first charge, caters for ‘Committed Liabilities’, i.e., milestone related stage payment due in respect of contracts signed in the past; only the residual amount is available for making the first stage payment due on signing of contracts. The amount due as first stage payment is as per the conditions of the Request for Proposal (RFP) and may vary in each contract, but for rule of thumb calculation purposes may be assumed to be 10 per cent. Based on the allocation of funds at the BE stage (Table 2), it may therefore be assumed that contracts of the order of magnitude of about Rs. 60,000 crore could have been signed during the current year.

The projected requirement of funds and the allocation at BE stage are tabulated below.

| CAPITAL BUDGET (Rupees in Crores) | ||||||

| PROJECTION | BE | % of Projection | Works | Committed Liabilities | New Schemes | |

| ARMY | 31938.7 | 27227.31 | 85.25 | 5240.92 | 20445.33 | 1541.06 |

| NAVY | 27059.1 | 24080.9 | 88.99 | 720 | 22248.12 | 1112.78 |

| IAF | 42758 | 33657.65 | 78.79 | 1626.18 | 28767.52 | 3264 |

| HQ IDS | 922.34 | 441.67 | 480.67 | |||

| DRDO | 7788.4 | 554.15 | 7234.25 | |||

| OFB | 2105.13 | 760.07 | 36.11 | 335.39 | 424.68 | |

| Inspection Org | 7.12 | 7.12 | ||||

| Technology Development | 144.21 | Development under ‘Make’ procedure Army 115.11 & Air force 29.1 Crs | 144.21 | |||

| TOTAL | 94588 | 8925.43 | 79600.57 | 6062.05 | ||

| % Share of each | 9.44 | 84.16 | 6.41 | |||

The Standing Committee on Defence takes evidence of the representatives of the Ministry of Defence (MoD) and Service Headquarters and examines the ‘Demands for Grant’ in the annual budget and submits a report to Parliament with its recommendations. (As per convention, these are only recommendations and their acceptance is the prerogative of the Government.) The 7th report of the committee presented in May 2015 brings out that, during the year 2014-15, the Army could not utilize Rs. 7,874 crore in the Capital Head due to several reasons like cuts imposed by the Ministry of Finance, slippages in Committed Liabilities, non-fructification of 14 Schemes at the Competent Financial Authority (CFA) stage, and under-utilization by the Director General Ordnance Factories (DGOF), etc. For 2015-16, the Army projected an allocation of Rs. 5,665.49 crore for New Schemes, but only Rs. 1,541.06 crore was allocated. MoD informed the committee that some of the New Schemes, which are at an advanced stage, are likely to be affected due to the reduced allocation. The committee was apprised by the Army that, due to shortage of allocation, even if the end of the procurement cycle is reached and only the CFA sanction is required and goes to the Ministry of Finance, the latter, well aware of the financial condition and how much money is available in the overall budget, starts applying checks, resulting in a slowing down of approvals/additional allocations. But the fact remains that a lot needs to be modernized. And although the modernization plans are ready, nothing much can be done due to the resource crunch. In this context, the Army requested the committee’s assistance to ensure that the required additional money is provided and the procedures facilitate the completion of the procurement cycle.

The 8th report of the committee brings out that the Indian Air Force (IAF) informed the committee that the impact of the shortfall in the capital budget would lead to a slowdown in modernization, delay in induction of important capabilities, erosion of superiority over adversaries and resultant asymmetry in capability with respect to envisaged threat perceptions, and flight safety concerns due to obsolescence issues. The committee was also informed that the amount of money allocated for capital schemes has reduced during the previous two to three years. As a consequence, no major contracts have been signed and committed liabilities have come down. The IAF projected a shortfall of Rs. 9,000 crore under ‘New Schemes’ at the contract negotiation and CFA approval stages. As for the Navy, its representative informed the Committee that the service has to manage with reduced allocation for ‘New Schemes’ unless additional money is given at the Revised Estimate (RE) stage.

The trend of utilization of the capital budget in the recent past (Table 3) indicates that funds were withdrawn at the RE stage in the last two years, partly to provide for additional funds under the revenue budget and partly to help the government contain the fiscal deficit. Some of it would have got absorbed by the slippages in committed liabilities (reflecting delay in progress of the contracts signed in the past); it would have also deferred the signing of ‘New Schemes’. Committed liability figures are estimated as per the then prevalent exchange rate and, in times of a depreciating Rupee, the actual outflow would be higher; for example, the average rupee dollar exchange rate for 2013-14 was higher by 11.2 per cent over 2012-13.

| % UTILISATION OF BE – CAPITAL | TOTAL CAPITAL BUDGET (Rupees in Crores) | |||||||||

| ARMY | NAVY | AIR FORCE | BE | Actual Expenditure | % | |||||

| 2010-11 | 91.91 | 142.37 | 94.46 | 60000 | 62056 | 103 | ||||

| 2011-12 | 77.81 | 131.83 | 95.61 | 69198* | 67902 | 98 | ||||

| 2012-13 | 76.73 | 70.85 | 108.83 | 79579* | 70499 | 89 | ||||

| 2013-14 | 80.71 | 84.56 | 99.65 | 86741 | 79125 | 91 | ||||

| 2014-15 | SERVICE WISE DETAILS N/A | 94588 | 81886 | 87 | ||||||

Note: In 2011-12 and 2012-13, the BE for Modernisation of the three services was Rs. 56,625 and Rs. 59,151, respectively, and it was fully utilised.

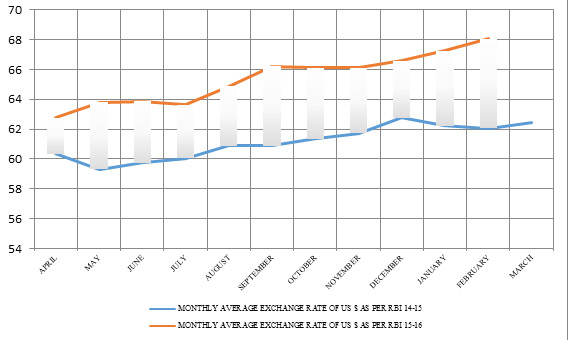

If the progress of deliveries or achieving milestones in respect of past contracts had been as expected, the actual outflow on account of committed liabilities would have been higher in the current year 2015-16 than the projected figure of Rs. 79,600 crore (see Table 2). As Graph 1 indicates, the monthly average Rupee/Dollar rate (as per RBI) has been 7.5 per cent higher on average (month on month, the average of February 2016 is for rates up to 17 February).

Modernisation Funding: A Mirage

In 2006-07, MoD issued instructions to book to the capital budget some of the erstwhile procurements, repair, and overhaul done through the revenue budget, albeit by following the revenue route, i.e., DPM and financial powers applicable for revenue procurements. So now, post 2006-07, we have substantial expenditure (in the case of Navy and Air Force it would be in four figure crores for each service) booked to the capital budget, which was hithertofore booked to the stores budget. Expenditure incurred under the stores head of the revenue budget of the services (net of Petroleum Oil Lubricants [POL]) is tabulated in Table 4. The expenditure on stores (net of POL), as may be seen, is higher in 2006-07 than the expenditure in 2013-14 for the Navy and Air Force. This is because a large part of this expenditure is being met by utilising the capital budget. The estimate based on the increase seen in the stores expenditure (net of POL) between 1995-96 and 2005-06 is that the amount thus utilised through capital budget is close to five figure crores.

| EXPENDITURE ON STORES (net of POL) but includes Repairs & Refits in the case of NAVY | |||

| Financial Year | ARMY | NAVY | AIR FORCE |

| 13-14 | 10895 | 2919 | 3451 |

| 12-13 | 10852 | 3183 | 3270 |

| 11-12 | 10417 | 3308 | 3594 |

| 10-11 | 10368 | 3003 | 3112 |

| 09-10 | 7873 | 2616 | 3470 |

| 08-09 | 9009 | 2477 | 3943 |

| 07-08 | 7869 | 2831 | 3886 |

| 06-07 | 8301 | 3069 | 4000 |

| 05-06 | 7928 | 3015 | 3820 |

| 04-05 | 7544 | 2172 | 3461 |

Thus, there are slippages in the progress of existing schemes, there is slow down in the signing of new contracts, and the amount of actual modernisation expenditure in the real sense is lesser than the amount indicated.

Current Year

The trend of the actual expenditure incurred up to 31 December 2015 indicates that the Revised Estimates for the Defence Budget to be presented by the Finance Minister in Parliament on 29 February 2016 is likely to be a figure close to last year’s actual expenditure than last year’s budget estimates. This does not augur well even for maintaining existing capability, let alone building upon it. The picture as seen is tabulated in Table 5.

| Comparative Expenditure Trend In % For The Months Of Oct To Dec | |||||||||||

| Rs in Crs | Oct-15 | Oct-14 | Oct-13 | Nov-15 | Nov-14 | Nov-13 | Dec-15 | Dec-14 | Dec-13 | ||

| DEFENCE SERVICES | 246727 | 50 | 52 | 60 | 58 | 59 | 68 | 67 | 69 | 79 | |

| 23 | Defence Services-Army | 104158.95 | 57 | 62 | 63 | 65 | 71 | 71 | 74 | 80 | 80 |

| 24 | Defence Services-Navy | 15525.64 | 50 | 50 | 54 | 58 | 59 | 62 | 69 | 69 | 72 |

| 25 | Defence Services-Air Force | 23000.09 | 48 | 46 | 57 | 55 | 56 | 66 | 64 | 64 | 75 |

| 26 | Defence Ordnance Factories | 2884.23 | |||||||||

| 27 | Defence Services – Research and Development | 6570.09 | 46 | 56 | 64 | 57 | 62 | 71 | 65 | 69 | 78 |

| 28 | Capital Outlay on Defence Services | 94588 | 42 | 42 | 55 | 49 | 47 | 61 | 60 | 58 | 75 |

The utilisation percentage of the budget in the current year has been generally lower than in the past two years.

Revenue Budget

Under the Revenue budget, provision is first made for Pay & Allowances (P&A). The remainder (Others) is distributed to meet the requirement of other obligatory expenses, stores (including ordnance), transportation (of personnel and stores), revenue works and maintenance, etc. These areas are likely to be impacted when allocation is lower than the projection.

| REVENUE BUDGET 2015-16 | ||||||

| Projected | Actual | Budget breakdown % | Based on reported utilisation up to December 2015 | |||

| P&A | Others | P&A | Others | |||

| ARMY | 109758.22* | 103315.91 | 67.97 | 32.03 | 50.98 | 23.02 |

| NAVY | 17077** | 14325.68 | 46.12 | 53.88 | 34.59 | 34.41 |

| AIR FORCE | 30932 | 24300 | 46.75 | 53.25 | 35.06 | 28.94 |

| *The projected and allotted figures in the case of the Army do not include ECHS & inspection Organisation.

** In the case of the Navy, the projected and allotted figures do not include the Joint Staff which are otherwise part of the demand for grant nos. 23 and 24. |

||||||

While there is a moderate shortfall in percentage terms in the allocation to the Army, it is about 16 per cent for the Navy and 21 per cent for the Air Force. The Navy had submitted to the Standing Committee on Defence (4th report) that the need for additional funds under the revenue head is to meet day-to-day requirements of Operational Deployments (including Anti-Piracy Patrols) and Coastal Security. In addition are the requirements for stores (Fuel, Weapons, Armament, Spares), Victualing and Rations, and Repairs and Refits. The Air Force had candidly submitted to the committee that the Revenue Budget constraint will impact the procurement of spares and fuel leading to a shortfall in training, as older systems require more maintenance. The committee had recorded that there is already a huge shortage of the air force fleet from the sanctioned strength and any further constraint on spares will lead to a shortfall in serviceability and hence impact availability adversely. This year should have been a good time as falling oil prices have brought about substantial savings, which are estimated to be about Rs. 2,700 crores.

| Monthly Average index** | ATF | Diesel | Petrol & others | 2015-16 | ||

| Budget | Savings* | |||||

| 2014 | 267.6083 | 231.1083 | 191.55 | IAF | 4383 | 1509 |

| 2015 | 172.6833 | 191.9417 | 165.6917 | ARMY | 3173 | 724 |

| Reduction % over previous year | 35.47162 | 16.94732 | 13.49952 | NAVY | 2445 | 448 |

* Share of consumption of ATF, Diesel, Petrol & other products based on Figures 4, 5 & 6 of “Defence Budget: Constraints & Capability Building,” in Vinod Misra, ed., Core Concerns in Indian Defence and Imperatives for Reforms (New Delhi: Pentagon Press, 2014).

** Office of the Economic Adviser, Government of India, Ministry of Commerce & Industry, Department of Industrial Policy & Promotion (DIPP)

Revenue expenditure does tend to be higher in the last quarter but despite that it would be probably a rare year in which the revised estimates in the case of Revenue Budget will be lesser than the budget estimates.

Fiscal Deficit

The fiscal deficit target for the year 2015-16 was 3.9 per cent of GDP (absolute amount Rs. 555,649), which, at market prices, was expected to grow at the rate of 11.5 per cent. While the growth of GDP at constant prices has been progressively increasing since 2012-13, the growth of GDP at market prices has been falling and this year it is expected to be 8.6 per cent.

| FINANCIAL YEAR | GDP GROWTH AT CONSTANT PRICES | GDP GROWTH AT MARKET PRICES | DEFLATOR | GDP GROWTH RATE ASSUMED IN BUDGET FIGURES |

| 2015-16 | 7.6 | 8.6* |

1 |

11.5 |

| 2014-15 | 7.2 | 10.8 |

3.6 |

|

| 2013-14 | 6.6 | 13.3 |

6.7 |

|

| 2012-13 | 5.6 | 13.9 |

8.3 |

|

| * STATEMENT 2: Advance Estimates of National Income and Expenditures of GDP at current prices, 2015-16, released by Central Statistics Office (CSO) on 8 February 2016.

Price indices used as deflators1: The wholesale price index (WPI), in respect of the groups – food articles, manufactured products, electricity and all commodities and consumer price index. |

||||

The revenue receipts (both tax & non-tax) have been higher as a percentage of the budgeted figure at this stage compared to last year – 70.4 per cent against 58.3 per cent last year. The lower rate of growth of GDP at market prices than the rate assumed in the budget would require that the absolute amount of deficit budgeted would have to come down by 2.9 per cent (11.5 minus 8.6) of Rs. 555,649, say about Rs. 16,210 crore. The target figure would be Rs. 26,529 crs (555,649 minus 529,120) in case the GDP figures as given in the CSO report of 8 February 2016 are adopted. The GDP at market rates as per the union budget 2015-16 was Rs. 14,108,945 crore and the fiscal deficit was Rs. 555,649 crore. The GDP at market prices as per the latest CSO estimates is Rs. 13,567,192 crs (13,567,192 X 3.9% = 529,120. The trend in defence expenditure indicates that the Finance Minister might get this amount nearly in its entirety from the defence budget.

Views expressed are of the author and do not necessarily reflect the views of the IDSA or of the Government of India.

- 1. Government of India, Ministry of Statistics and Programme Implementation, “Press Note: Advance Estimates of National Income-16 and Quarterly Estimates of Gross Domestic Product for the Third Quarter (OCT-DEC), 2015-16,” 8 February 2016.

2 All figures used in the tables are based on CGA website, reports of the Parliament Standing committee on Defence, Defence Services Estimates (DSE I) and report available in public domain.