Can India be the Next Global Manufacturing Hub?

Summary: The COVID-19 pandemic laid bare the vulnerability of existing global manufacturing supply chains. It is likely to lead to global suppliers rethinking the resilience of their supply chain networks. Can India take advantage of this opportunity to bolster its industrial and commercial base? This issue brief sheds light on India’s manufacturing lag and discusses the various policy initiatives taken by India to strengthen its manufacturing sector. It concludes by suggesting some measures that could help India leapfrog into achieving the status of a global manufacturing hub.

Summary: The COVID-19 pandemic laid bare the vulnerability of existing global manufacturing supply chains. It is likely to lead to global suppliers rethinking the resilience of their supply chain networks. Can India take advantage of this opportunity to bolster its industrial and commercial base? This issue brief sheds light on India’s manufacturing lag and discusses the various policy initiatives taken by India to strengthen its manufacturing sector. It concludes by suggesting some measures that could help India leapfrog into achieving the status of a global manufacturing hub.

The COVID-19 pandemic has revealed the inherent weaknesses in the existing global supply chain and the over-reliance on China’s manufacturing industry. Countries such as Japan and the United States (US) have announced their decision to “on-shore”, or pivot, their supply chain out of China. The Japanese Government announced a supplementary budget of US$ 2.2 billion for the fiscal year 2020 to assist Japanese companies in diversifying their production bases, primarily through the return of high-value manufacturing activities to Japan, or redirecting them to the Southeast Asian nations.1 Currently, Japan relies on China for more than 20 per cent of its requirement of parts and materials, mainly electronic components such as motherboards, RAM chipsets and hard disk drives.2 In this regard, Japan and India share strong security and trade relations underscoring the Indo-Pacific alliance. On September 3, 2020, Japan added India to the list of relocation destinations as part of its effort to move manufacturing bases out of China.3

Meanwhile, Prime Minister Narendra Modi has called on the Indians to seize the chance presented by the disruption to global supply lines. The Atmanirbhar Bharat Abhiyan (Self-Reliant India Movement) launched by Prime Minister Modi in May 2020 is aimed at merging the global with the local, generating manufacturing investment, and becoming the new global nerve centre of multinational supply chains in the post-COVID world.4 However, despite long-term aspirations to become a high-value manufacturing hub, India remains lagging in this area. The pandemic presents new opportunities for India to rethink its national industrial strategy, especially policies concerning the growth of its manufacturing sector. This leads to the question: can India position itself to take advantage of the opportunity that avails to be the next global manufacturing hub?

According to the United Nations Industrial Development Organisation (UNIDO), in 2019, India ranked 42 out of 152 countries, with manufacturing value added (MVA constant 2015 US$) totalling $430.25 billion, or equal to 15.5 per cent of its gross domestic product (GDP).5 At the same time, China ranked second with MVA (constant 2015 US$) of $4105.87 billion or equal to 28.8 per cent share.6 In 2019, India’s manufacturing portfolio concentrated mainly on chemicals and chemical products (18 per cent); coke, refined petroleum products and nuclear fuel (13.6 per cent ); food and beverages (9.4 per cent); basic metals (8.6 per cent); and motor vehicles, tractors and semi-trailers (8.1 per cent ).7 China, however, has one of the most diverse manufacturing portfolios in the world with medium and high-tech industry value added at 41.5 per cent (2017). China’s manufacturing composition (2019) consisted of basic metals (14.3 per cent); chemicals and chemical products (10.8 per cent); food and beverages (8.9 per cent); machinery and equipment (8.5 per cent); and radio, television and computer equipment (6.8 per cent).8 Figure 1 illustrates how China’s high-tech export has been growing exponentially since 2007, while India’s has remained flat.

Source: “High-Technology Exports (Current US$)”, The World Bank, 2007-2018 (Accessed May 12, 2020).

However, India’s policy on foreign direct investment (FDI) and ease of doing business has improved tremendously since 2015. According to the World Bank’s Ease of Doing Business Ranking 2020, India jumped 79 positions from 142 in 2014 to 63 in 2019. At the same time, China had climbed up from position 90 in 2014 to 31 in 2019.9 India would have to capture a place among the top 50 in the ranking to become a global player in manufacturing.

India’s Manufacturing Lag

There are several reasons why India lags in the manufacturing sector. China has outperformed India, especially in areas critical to boosting manufacturing output such as starting new businesses, access to electricity, registering property, and performance in enforcing contracts.10 Additionally, the Chinese Government also pursues a strict performance-oriented approach to ensure that the industry stays productive and highly competitive. Interestingly, until the early 1990s, both countries shared similar levels of manufacturing and export capabilities. China’s big leap came in 1978 when Deng Xiaoping announced the “Open Door” policy. China’s long-term modernisation plan and market-oriented reforms created a strong private sector alongside state-owned enterprises. China built its base by slowly strengthening internal markets and bolstering the supply chain base of local industries to become the largest global manufacturer.

Pre-COVID, in 2019, China’s FDI inflow stood at US$ 140 billion, whereas that of India’s stood at $49 billion.11 India liberalised its economy just over a decade after China in 1991, but the move was more cautious than that of China’s, accompanied by sectoral caps. It was only in June 2017 that India abolished the Foreign Investment Promotion Board (FIPB), an inter-ministerial board that granted prior governmental approval in mandatory sectors. Currently, India allows FDI with foreign equity ownership up to 100 per cent through the automatic route for all sectors except for a few prohibited sectors.12 For example, in the defence sector, foreign equity through FDI has been revised from 49 per cent in 2017 and capped at 74 per cent in 2020 as well as conditioned to obtain government approval beyond this figure based on access to modern technology.13

India’s bureaucratic setup, however, continues to mire foreign companies due to weak legal and regulatory systems. In addition, land, labour and law largely fall under the State List, which foreign companies see as further hurdles as each state may use different systems of approval. India is still being flagged out for its complex regulatory environment. In contrast, China’s leaner regulatory environment has been far more flexible at the state and regional levels. China’s FDI policy, reduced logistical costs, faster on-line approval processes and e-filing, all translate into an effective business management process that appeals to foreign investors.14

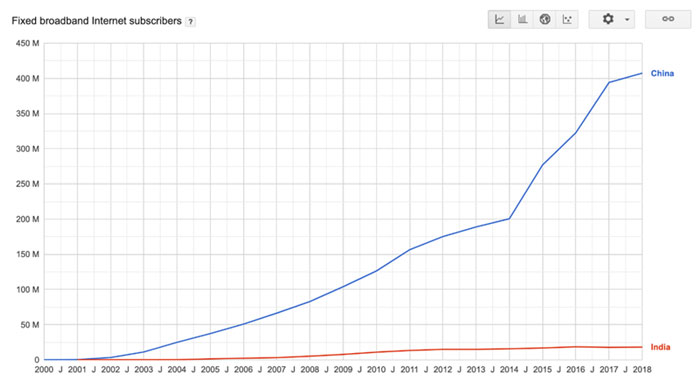

India also continues to see a lack of investment in connectivity and in both physical and digital infrastructure development. This includes roads, highways, ports and electricity generation. Most of India’s manufacturing items are still transported using ground transport. Meanwhile, China has heavily invested in digital infrastructure development, especially in broadband connectivity. Until 2001, China and India had similar numbers of broadband users. However, after this point, China’s numbers exploded (Figure 2).

Source: Fixed Broadband Subscriptions—China, India, World Bank Open Data, 2000-2018 (Accessed May 12, 2020).

Similarly, Internet users as a percentage of population for China drastically increased after 1998. China has invested in digital infrastructure to ensure upward social mobility, access to education, and in creating a better quality of life for its people, resulting in a workforce now able to contribute effectively to the economy and the high-value manufacturing sector. India has a pool of cheaper labour resource compared to China and other Asian countries, but the state and businesses have not channelled investments into the necessary human capital development to undertake high-value manufacturing activities.

India is also dependent on China for specific critical components. The cell phone industry, for instance, imports approximately 75 per cent of its components from China, with only 12 per cent being manufactured domestically. The chemical used to make cathodes and battery cells for electric vehicles, printed circuit boards, camera modules, and semiconductors are all imported from China.15 India has been less successful in developing industrial clusters focussed on research and development (R&D) and a diverse and high-quality supplier base, both of which are vital for enabling the growth of an advanced manufacturing and innovative technology sector. China has developed industrial clusters across the country since the 1950s. It has a robust industrial supply chain base coupled with universities supplying a skilled workforce in places like Shandong, Guangdong, Xinjiang, and Jiangsu.

In the Doing Business 2020 report, one of India’s highlighted shortfalls was access to electricity. There have been constant issues with reliability of supply procedure, high power outage in factories, difficult access to line and high costs to get connected to the electrical grid. A 2010 study quoted that the electrical shortage in India reduced the average plant’s revenue by six to eight per cent and that the production surplus dropped by 10 per cent, of which roughly half is due to the cost of backup generators.16 To the contrary, China has improved tremendously in these areas but also additionally by investing in building significant new renewable energy production facilities and nuclear power plants.

India’s Manufacturing Policy Initiatives

The Indian Government is committed to improving the ease of doing business and luring FDI into the country. In fact, since the outbreak of the COVID-19 pandemic, it has announced several measures and offered various incentives to attract global investment.17 According to the latest UN report on world investment, the FDI inflow in China, despite being the second largest recipient of FDI after the US, saw only a marginal increase of 2.1 per cent in 2019. On the other hand, the FDI inflow in India rose by almost 20 per cent in 2019.18 The COVID-19 supply chain disruptions and lessons learnt may further work to the advantage of India in terms of making it an alternative FDI destination.

India’s journey in bolstering its manufacturing sector had been challenging, yet beset with opportunities. India has consistently pushed for policy reforms to increase the country’s manufacturing output that lingered at 15–16 per cent of the total GDP since the 1980s. Although India has introduced industrial policy reform since 1948, the 1991 reform was most significant in driving structural shift, enabling the private sector to assume a much larger role in all sectors of the economy. In 2011, the Department of Industrial Policy and Promotion (DIPP) under the Ministry of Commerce and Industry introduced the National Manufacturing Policy (NMP). Its main objective was to enhance the share of the manufacturing sector in GDP from 16 per cent to 25 per cent by 2022, create 100 million jobs and support required skills development programmes. Other key objectives of the NMP included the creation of national investment manufacturing zones (NIMZ), development of small and medium enterprises (SMEs), implementation of industrial training and other skill upgradation measures, promotion of green manufacturing as well as rationalisation and simplification of business regulations.19

In September 2014, Prime Minister Modi launched the “Make in India” initiative to renew focus on 25 key sectors ranging from automobiles to information technology and business process management (BPM).20 The initiative is built on four pillars: policy initiatives and new processes, robust infrastructure, focus sectors, and a new mindset approach.21 In May 2017, the Ministry of Defence’s Defence Acquisition Council approved the “Strategic Partnership” model which enables private companies to tie up with foreign players in manufacturing high-tech defence equipment such as submarines, fighter jets, helicopters, and armoured vehicles in India.22

The most recent policy initiative, announced by Finance Minister Nirmala Sitharaman on May 17, 2020, under the Atmanirbhar Bharat Abhiyan (Self-Reliant India Movement)launched by Prime Minister Modi on May 12, targets reforms across seven sectors while emphasising self-reliance based on five pillars: economy, infrastructure, system, vibrant demography, and demand.23 All these initiatives are an attempt to push for high-value manufacturing activities to be moved to India. For example, the government launched a Phased Manufacturing Programme (PMP) aimed at increasing the number of smartphone components produced domestically and to invigorate the mobile handset manufacturing industry. India has recently invested in several high-profile manufacturing sectors. For instance, Mumbai got its first metro coach manufactured by the state-run Bharat Earth Movers (BEML) in September 2019. In February 2019, the Union Cabinet passed the National Policy on Electronics (NPE) which targets $400 billion worth of electronics manufacturing outcome for India by 2025.24

Further, on May 12, 2020, Prime Minister Modi also announced a special stimulus package of Rs 20 lakh crore, which equals to 10 per cent of India’s GDP, aimed at making India independent against tough competition in the global supply chain.25 On May 17, Finance Minister Sitharaman announced detailed economic measures that included increased borrowing limits for state governments, from three to five per cent of the gross state domestic product; privatisation of public sector enterprise (PSEs), except in strategic sectors; and various incentives for micro, small and medium enterprises (MSMEs).26

The series of policy reforms and notable improvements in the business regulatory framework has had a tremendous impact on the development of India’s ability to attract FDI and trade in the manufacturing sector. In fact, the World Bank’s Doing Business 2020 report ranked India as one of the 10 most improved economies in terms of ease of doing business score, especially due to reforms in paying taxes, trading across borders, and resolving insolvency.27

Other positive developments included improvement in India’s ranking in award of Construction Permits, from 184 in 2014 to 27 in 2019; and in Getting Electricity, from 137 in 2014 to 22 in 2019. Among 190 economies, India now ranks 13 in Protecting Minority Investors and 25 in Getting Credit.28 The construction sector has seen the highest growth of FDI equity during the last two fiscals (FY 2017-18 to FY 2019-20) at 190 per cent, followed by the telecommunications sector at 67 per cent, the automobiles sector at 35.12 per cent, and the services sector at 17 per cent. 29 India has also successfully moved towards online procedures and approval processes for tax filing platforms, property transfer, and showing greater transparency.

Conclusion

India has a huge young demographic, between 40-60 per cent of the country’s population, which requires jobs. India would have to commit to more policy reforms to be able to further scale up its manufacturing capacity. It must continue to significantly invest in the development of physical infrastructure and digital connectivity—high-speed train networks, new airports, seaports, roads, and broadband. It is important to offer efficient connectivity between industrial clusters and cities ensuring good transport links and logistics that support an effective and reliable industrial eco-system, which meets the demand of the international supply chain.

India also needs to liberalise its education sector and invest in international education and research partnerships. These efforts should be fortified by a government-led public-private partnership investments in R&D, innovation, entrepreneurship, and the strengthening of the industrial supply-chain in high-value manufacturing sectors, which will contribute to the development of regional clusters. One such initiative is the C-130J programme that created a partnership between the Lockheed Martin research programme and Indian universities to work with local industries and mentors from the Defence Research and Development Organisation (DRDO) to help design specifications.30

To support industrial clusters, India must consider prioritising investment into alternative renewable energy sources, such as solar and wind power. Currently, India is struggling to provide cheap access to electricity and clean water. Cheap renewable energy can generate capability and reach remote rural areas across the country; the surplus can be used for electric vehicles, such as scooters and rickshaws, which can then be locally produced for domestic and export markets. At the same time, these green technology related energy management initiatives will also address externalities such as high levels of carbon emission, pollution, and poor air quality and contribute towards sustainable manufacturing.

Additionally, there is a need to improve and follow-through India’s regulatory reforms such as labour and land acquisition reform, commercial law approval processes and regulations, tax credits and grants for investors in the emerging high-value manufacturing technology as well as enforcement of contracts. India can also introduce incentives to encourage advanced technology innovations in areas such as 3D printing and automotive real-time processes in manufacturing.

Last, but not least, the Indian small and medium enterprises (SMEs) sector should be incentivised to become internationally competitive and export-driven. Both state governments and the central government must coordinate and introduce incentives that will draw FDI at regional levels, as has been seen in Telangana and Tamil Nadu. The government needs to further reduce red tape and overly complex approval processes and promote innovative and efficient business processes that will attract more foreign investors.

India can emerge as the next global manufacturing hub. In times of deep economic crisis, such as the one brought on by the COVID-19 pandemic, a swift government intervention through strong fiscal response and injection of capital into the economy is necessary. While the economy as a whole needs significant support, the government must see this as an opportunity to strategically invest in high technologies for priority sectors such as agriculture, electronics and electrical equipment, including computers, telecommunication and space. It should inject aggressive economic incentives and review the current business practises to bring in more trade and investments into advanced manufacturing sectors.

At the same time, the commercial sector, especially electronics and electrical sectors, must be incentivised to attract FDI from global electronic component manufacturers, review existing business models, and invest in upskilling and retraining as a move to enhance overall industrial capability and capacity. India should now turn to greater public-private partnership collaborative model, where the government and industry take collective responsibility for promotion and growth of the Indian manufacturing sector. Finally, India should capitalise on its diaspora and international industrial partnership programmes, such as the Access India Programme (AIP) introduced under the United Kingdom India Business Council (UKBIC), to generate new opportunities for innovation and entrepreneurship.

Views expressed are of the author and do not necessarily reflect the views of the Manohar Parrikar IDSA or of the Government of India.

- 1. Takashi Tsuji and Kazuhiro Furuyama, “Japan preps first subsidy to company moving production out of China”, Nikkei Asian Review, April 21, 2020 (Accessed June 21, 2020); and “Japan reveals 87 projects eligible for ‘China exit’ subsidies”, Nikkei Asia, July 17, 2020 (Accessed September 30, 2020).

- 2. Eulises Quintero, “Top 10 Companies Outsourcing electronics manufacturing in 2019”, Titoma, 2019 (Accessed October 15, 2020).

- 3. Takako Gakuto, “Japan adds India and Bangladesh to ‘China exit’ subsidy destinations”, Nikkei Asia, September 04, 2020 (Accessed September 30, 2020).

- 4. “Let us resolve to make India self-reliant: PM Modi”, narendramodi.in, May 12, 2020; “‘Aatmanirbhar Bharat’ merges the local with the global: PM Modi”, narendramodi.in, September 03, 2020. For more details, see “Archives For Aatma Nirbhar Bharat Abhiyan”, narendramodi.in (Accessed October 16, 2020).

- 5. See Country Profile India, UNIDO Statistics Data Portal (Accessed October 15, 2020).

- 6. See Country Profile China, UNIDO Statistics Data Portal (Accessed October 15, 2020).

- 7. Country Profile India, n. 5.

- 8. Country Profile China, n. 6.

- 9. “Doing Business 2015: Going Beyond Efficiency”, World Bank, Table 1.1 Ease of Doing Business Ranking, 2014, p. 4 (Accessed October 22, 2020); and “Doing Business 2020”, World Bank, Table 0.1, Ease of Doing Business Ranking, 2020, p. 4 (Accessed August 25, 2020).

- 10. “Doing Business 2020”, n. 9.

- 11. “Global FDI Flows Flat in 2019: Moderate Increase Expected in 2020”, United Nations Conference on Trade and Investment (UNCTAD), Investment Trends Monitor, Issue 33, Figure 3, January 2020, p. 3 (Accessed November 05, 2020).

- 12. “Consolidated FDI Policy (Effective from August 28, 2017)”, Ministry of Commerce, Government of India, Chapter 5: Sector Specific Conditions on FDI, p. 22 (Accessed September 30, 2020).

- 13. “Review of Foreign Direct Investment (FDI) Policy in Defence Sector”, Press Note No. 4 (2020 Series), FDI Policy Section, Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India, 2020 (Accessed October 16, 2020).

- 14. Alexander Chipman Koty, “China’s FDI Policy: Wider Market Access, Regional Incentives Announced”, China Briefing, October 09, 2018 (Accessed June 22, 2020).

- 15. Prabha Raghavan and Karunjit Singh, “Self-Reliant India: Which Sectors Depend on Imports, and Which Do Not”, The Indian Express, May 14, 2020 (Accessed June 21, 2020).

- 16. “Doing Business 2020”, n. 9, p. 31 (Accessed August 25, 2020).

- 17. See “Government of India’s Measures to Boost Business, Improve EoDB & Welcome FDI During COVID-19”, Strategic Investment Research Unit (SIRU), April 30, 2020. Also see “After tax incentives, govt brings in FDI reforms to propel growth”, The Times of India, August 28, 2019 (Accessed September 30, 2020).

- 18. “World Investment Report 2020: International Production Beyond the Pandemic”, UNCTAD, June 2020, p. 36 (Accessed November 5, 2020).

- 19. “National Manufacturing Policy”, Press Note No. 2 (2011 Series), Manufacturing Policy section, Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India, November 04, 2011 (Accessed October 19, 2020).

- 20. These 25 sectors include: automobile; automobile components; aviation; biotechnology; chemicals and petrochemicals; construction; defence manufacturing; electrical machinery; electronic systems; food processing; IT and BPM; leather; media and entertainment; mining; oil and gas; pharmaceuticals; ports and shipping; railways; renewable energy; roads and highways; space; textiles and garments; thermal power, tourism and hospitality; and wellness. See Sectors, Make in India (Accessed September 17, 2020).

- 21. “Make In India: The Vision, New Processes, Sectors, Infrastructure And Mindset”, Make In India (Accessed October 03, 2020).

- 22. Author’s interview with a Lockheed Martin official based in South Korea, May 10, 2020. Also see “TATA Sikorsky JV Delivers First Fully Indigenous S-92® Helicopter Cabin”, Lockheed Martin, October 24, 2013; and Manju V., “First indigenous S-92 helicopter cabin by TATA Sikorsky JV”, The Times of India, October 24, 2013 (Accessed October 23, 2020).

- 23. “Finance Minister announces Government Reforms and Enablers across Seven Sectors under Aatma Nirbhar Bharat Abhiyaan”, Press Information Bureau, Government of India, May 17, 2020 (Accessed June 23, 2020).

- 24. “Cabinet approves the proposal of National Policy on Electronics 2019”, Press Information Bureau, Government of India, February 19, 2019 (Accessed October 24, 2020).

- 25. “Let us resolve to make India self-reliant: PM Modi”, narendramodi.in, May 12, 2020 (Accessed October 16, 2020).

- 26. “Finance Minister announces Government Reforms and Enablers across Seven Sectors under Aatma Nirbhar Bharat Abhiyaan”, n. 23.

- 27. “Ease of Doing Business”, Make in India; and “Doing Business 2020”, World Bank, p. 8, 10. (Accessed October 16, 2020).

- 28. “Ease of Doing Business”, Make in India (Accessed October 16, 2020).

- 29. “Sectors Attracting Significant FDI in India in 2019-20”, Make in India (Accessed October 19, 2020).

- 30. “Five Indian university teams accept Lockheed Martin challenge to design C-130J”, Indian Defence Review, November 26, 2014 (Accessed November 03, 2020); “C-130J Super Hercules”, Lockheed Martin (Accessed November 05, 2020); and “Indian university students participate in C-130J Super Hercules roll-on/roll-off competition”, Business Standard, August 25, 2015 (Accessed November 05, 2020).